Car Insurance Rates California

If youre looking for the best cheap car insurance in california you may need to be diligent.

Car insurance rates california. It is essential to know the laws and requirements for your specific state because you may be eligible for additional savings. Many factors go into the rate you pay for car insurance. Here are some things to know about in california. Compare insurance premiums for various kinds of insurance.

Heres how you can save through discounts special programs and more. In california drivers benefit from proposition 103 a. Rates can vary from one company to the next so it pays to compare as many car insurance quotes as. California requires drivers to carry at least the following auto insurance.

Finding the best car insurance in california may depend upon programs and policies tailored to you. What type of insurance are you shopping for. California also has some unique car insurance laws that make insuring a vehicle here different than other states so read on to stay up to speed. So how much is car insurance in california for your ride.

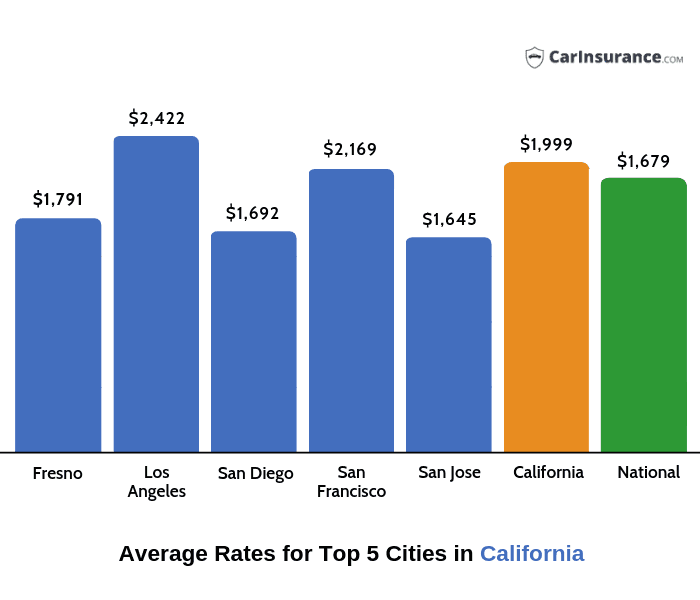

The top 10 largest car insurance companies in californiawhich account for more than 80 of the auto insurance premiums written in the statehave raised base rates for drivers by approximately 5 since the beginning of 2018. Insurance companies also take your credit score into consideration. In california drivers with excellent credit pay an average of 16188 per month compared to drivers with poor credit who typically will pay 12579 per month. Why car insurance rates vary in california like insurers in many other states companies in california charge higher rates for drivers in urban areas because they are perceived to be at a higher risk.

Average car insurance rates in california by credit score. Minimum california car insurance coverage. In accordance with california insurance code sections 12959 102346 and 1019220 we survey insurers licensed to transact insurance in california and ask them to provide their annual premiums for various lines of personal insurance. Unlike nearly all other states in california your credit history isnt allowed to be factored into your car insurance rate and where you live is considered but not given as much weight as in other states.

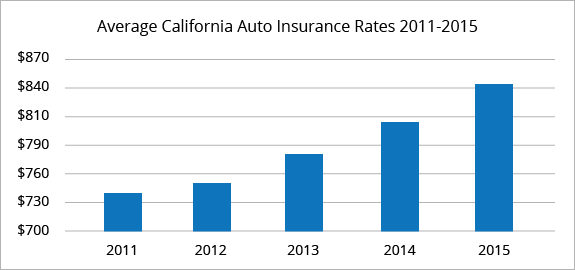

Each state has different requirements for drivers and these impact your car insurance policy. California car insurance rates near you by zip code you can see average car insurance rates for nearly all zip codes in california by using the tool below. California auto insurance rate increases.