Average Car Interest Rate

Dealers go through banks to provide financing and therefore offers rates comparable to banks.

Average car interest rate. The interest you have to pay on that loan can add thousands to the overall cost. The average interest rate on a new car loan is 627. Average interest rates on new cars. While there are other costs such as taxes and insurance to think about car loan interest is often the second largest cost youll face when buying.

Theres no guessing on the condition of a new vehicle because its brand new. However if you have average or poor credit minor differences can make a big difference when lenders determine your interest rate. Your credit score places you in a tier that lenders use to determine the interest rate and other terms for an auto loan. However that doesnt mean everyone gets that rate.

The average car loan interest rate with good credit is 371 for a 36 month loan 381 for 48 months 393 for 60 months and 378 for a 72 month loan. And a lower interest. What are loan rates offered by car dealers. With the average used car costing more than 20000 most buyers have to take out an auto loan to afford the purchase.

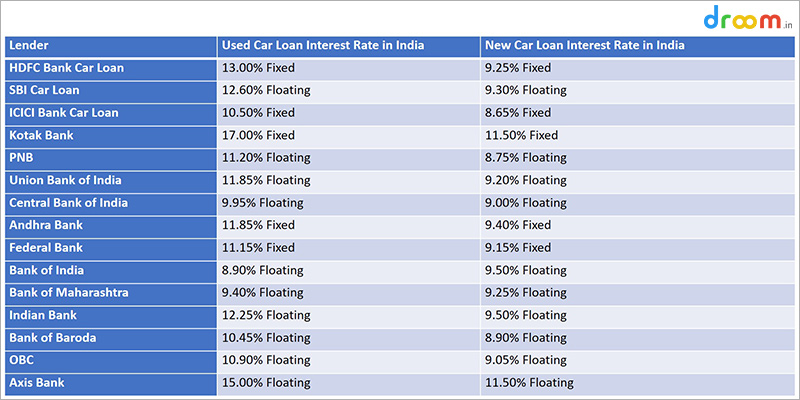

For new car purchases interest rates range from 14 to 4. Interest rates for leases follow a trend similar to that of car loans so to determine the current national average take the published annual percentage rate and divide it by 2400 to get an equivalent money factor. One leading bank offers customers with good credit interest rates as low as 299 for purchasing a new 2019 model but the minimum interest rate for the same loan on a 2007 model from a private seller rises to 599. Average auto loan rates by credit score.

As car leasing resource lease guide notes scores of 680 to 700 should get you prime rates or the lowest interest rates. Car loan interest rates change frequently so its important to keep track of them. At 2001 the average new car interest rate we found for people with poor credit the total interest comes to 16519. Here are the average.

Thats nearly half of the cars purchase price of 36000 and about 12000 in added costs compared to what someone with excellent credit would pay. Rates vary depending on your credit score debt to income dti ratio and whether youre buying a new or used car. New cars have lower interest rates because theyre covered under warranty are more reliable and lenders know their market value.