Credit Score Range For Car Loan

The average credit score for a new car loan in 2017 was 721 and 641 for a used car loan.

Credit score range for car loan. In q4 2018 super prime borrowers paid 419 percent. An example of total amount paid on a personal loan of 10000 for a term of 36 months at a rate of 10 would be equivalent to 1161612 over the 36 month life of the loan. Fico score 8 and 9. What credit scores do car lenders use.

In addition to the fico score a credit report will disclose all open and closed credit sources credit inquiriesapplications made and information on overdue debt bankruptcies and civil lawsuits. Other considerations include length of credit history credit lines recently opened and ones credit mix credit cards retail accounts student loan installment loans etc. Credit score requirements for your auto loan in 2019. Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender.

Now lets get back to the question of having a good credit score for a car loan. For additional loan options please call 800 339 4896. However the range of credit scores among people who purchased a car in 2017 runs the gamut so you can still get a loan with a lower than average score but the terms might not be as great. The first thing you need to know is that your credit score is the biggest determining factor in the interest rate you get when buying a used car.

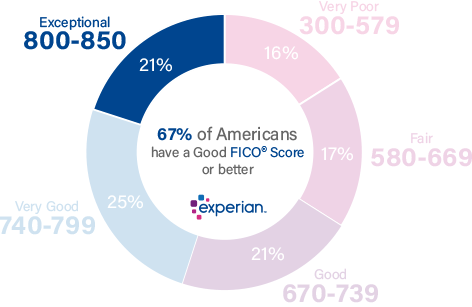

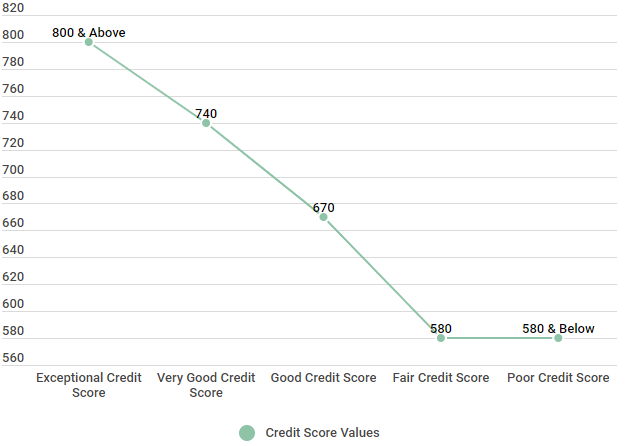

People with a higher score will usually be able to. Your traditional credit score or fico score sits on a scale between 300 and 850. Car loan rates by credit score if youre a super prime borrower with a credit score of 781 or higher you can expect to get the lowest rates. However fico also has industry specific scores including scores for auto lenders that range from 250 to 900.

Higher credit score lower car loan rates. That might seem obvious but theres more to it than that. The average credit scores for a new auto loan were 717 while the average scores for used car financing were 661. Although you might not know exactly which credit score an auto lender will use the following types of credit scores are popular options.

While you may be able to get approved with lower scores the pool of possible lenders will be smaller than if your scores were higher. If you want to know the requirements for getting an auto loan keep reading. Good credit 700 749 people with good credit scores of 700 749 average an interest rate of 507 for a new car and 532 for a used car. What role do credit scores play in used car loan rates.

Its possible to get approved for an auto loan with just about any credit score but the better your credit history the bigger your chances of getting approved with favorable terms.