Debt To Income Ratio For Car Loan

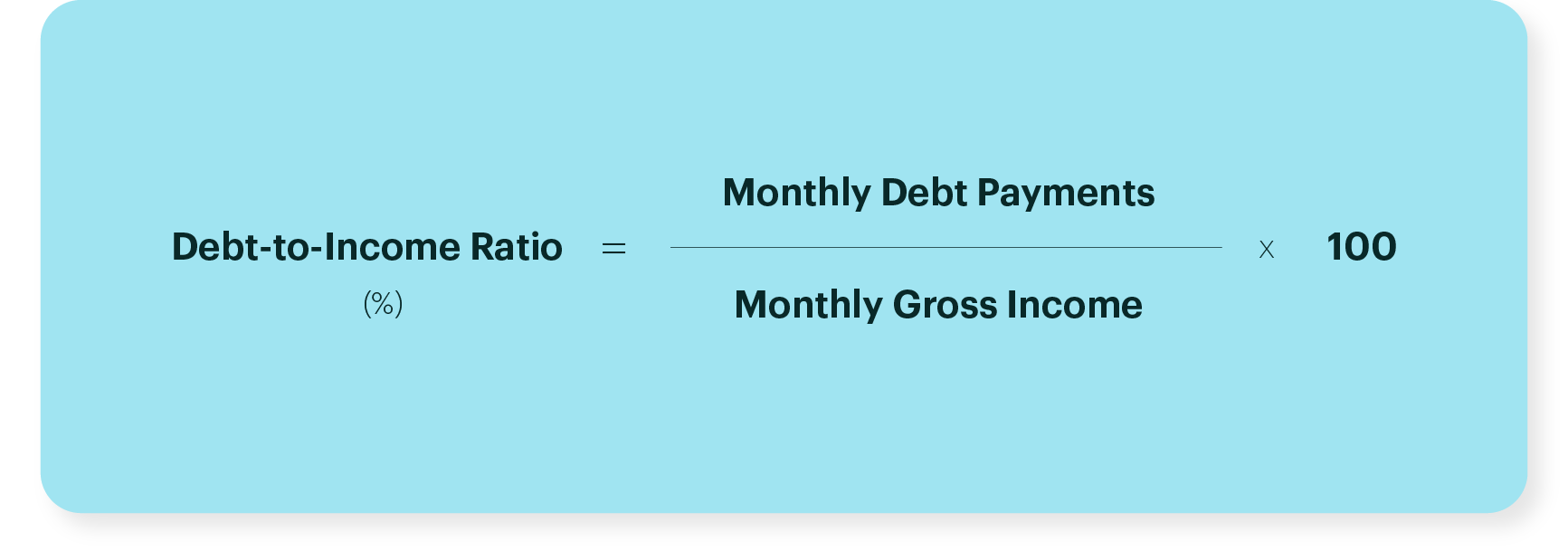

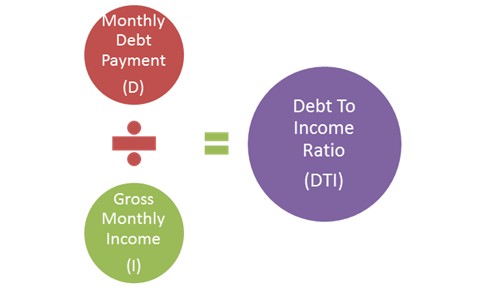

To calculate your debt to income ratio add up your monthly debt payments and divide them by your.

Debt to income ratio for car loan. However if you already have a lot of debt the high monthly payments on the car you covet can add up to big trouble. Measuring your existing debts against your existing income is one part of a lenders required assessment of your ability to repay a loan. Your debt to income ratio is the percentage of your gross monthly income spent on existing monthly debt. When youre ready to start car shopping youll want to take a few minutes to calculate your debt to income ratio to make sure you can afford to finance a vehicle.

To calculate your dti simply add up your total from the above payments and divide this amount by your gross monthly. Minimum credit card payments. A car payment is a debt a grocery bill is not. Also the maximum repayment term allowed moves with ratings and affects affordability.

Including the expense of the new car lenders want your total debt to be no more than 36 percent of your income. The chart above illustrates how the maximum dti allowed moves with ratings. Debts are existing financial commitments. Like the video says.

A borrower with rent of 1000 a car payment of 300 a minimum credit card payment of 200 and a gross monthly income of 6000 has a debt to income ratio of 25. Thats why many lenders look at your debt to income ratio when qualifying you for an auto loan. Lenders prefer applicants who have a debt to income ratio of 36 percent or less. These monthly debt payments include.

Dti monthly debt service paymentsmonthly gross income. Car loan payments. The debt to income ratio dti requirements for an auto loan vary by your credit score. Mortgage and rent payments.